On Tuesday, Treasury Secretary Scott Bessent mentioned that individual investors have largely remained steady during recent market disruptions, showing their confidence in President Donald Trump’s tariff strategy.

Bessent remarked, “While institutional investors have reacted with fear, individual investors have maintained their positions… They trust President Trump,” during a press conference with White House press secretary Karoline Leavitt.

“According to Vanguard, one of the largest investment firms in the U.S., 97% of Americans have not made any trades in the last 100 days,” noted Bessent, who is also a former hedge fund CEO, referencing a Washington Post article.

Trump’s introduction and then pause on record-high tariffs on imports caused a major sell-off in stocks, marking the steepest decline since the pandemic began in 2020. The S&P 500 index temporarily entered bear market territory before recovering somewhat, and it currently stands about 10% below its record high from February.

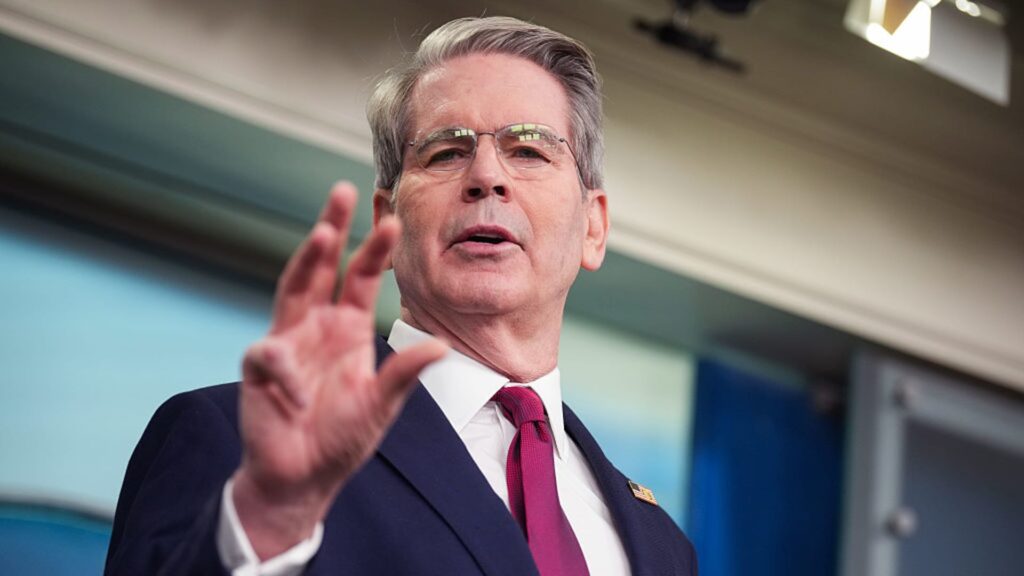

U.S. Treasury Secretary Scott Bessent addresses the press in the Brady Press Briefing Room at the White House on April 29, 2025, in Washington, DC.

Andrew Harnik | Getty Images News | Getty Images

During the market decline in April, retail investors quickly capitalized on low stock prices. Meanwhile, hedge funds and professional investors were fleeing the market, increasing their negative bets.

Institutions are becoming more concerned that high tariffs may burden consumers and slow down economic growth, potentially leading to a recession.

Torsten Slok, chief economist at Apollo, anticipates a summer recession in the U.S. as consumers begin to face shortages in stores due to trade disruptions in the coming month. Ken Griffin, founder and CEO of Citadel, expressed that Trump’s global trade conflicts could damage the reputation of the U.S. and diminish the appeal of U.S. Treasury securities.