Today, the cryptocurrency market is experiencing another surge, with almost all of the top 100 coins seeing price increases over the last 24 hours. However, the overall market capitalization for cryptocurrencies has dipped by 1%, now at $3.58 trillion. The trading volume across all cryptocurrencies is $138 billion, marking the highest level in several days.

TLDR:

Crypto Winners & Losers

Similar to yesterday, all top 10 cryptocurrencies by market cap have shown price increases in the past 24 hours.

The leading cryptocurrency, Bitcoin (BTC), has risen slightly by 0.3%, remaining relatively stable at $109,531. This is the smallest increase among the top coins.

Ethereum (ETH) has seen a notable jump, climbing 4.6% to a price of $2,798.

The biggest gainer in this category is Dogecoin (DOGE), which has increased by 5.4% and is currently priced at $0.2013.

Among the top 100 cryptocurrencies, only seven have shown declines. Bittensor (TAO) experienced the largest drop at 3.1%, bringing its price down to $421.

Uniswap (UNI) achieved the highest spike today, appreciating 18.1% to $8.41.

Six other cryptocurrencies also saw impressive double-digit gains.

Market participants, both in cryptocurrencies and traditional finance, have focused on US-China trade conversations held in London over the last two days, which included discussions about tariffs and restrictions on critical products like rare earth minerals and chips. On Tuesday, the two sides indicated they had agreed on a “framework” for both topics, though the specifics are still unclear.

Additionally, on Wednesday morning, the US will release the consumer price index for May, which will shed light on how tariffs are impacting inflation.

Meanwhile, Sean Dawson, the Head of Research at the AI-based options platform Derive.xyz, suggested that the recent price increases followed the announcement by the US Securities and Exchange Commission (SEC) offering exemptions for DeFi projects. He stated that ETH stands to benefit significantly as it enables rapid growth.

Sebastian Pfieffer, managing director of Impossible Cloud Network, pointed out that Ethereum is working towards compliance with European regulations but emphasized that it’s now time for Europe to embrace decentralization instead of imposing unnecessary barriers. This approach would allow Europe to gain independence from US political influence over its cloud services, he added.

All Eyes on US Inflation Report

Ruslan Lienkha, Chief of Markets at YouHodler, indicated a strong possibility for BTC to reach a new all-time high soon. The current price is just a few percentage points shy of its previous peak. He remarked that “generally, financial markets are optimistic.”

He added, “However, there remains a risk of a market reversal, especially if upcoming economic data falls short of expectations. Today’s US inflation report is closely watched. While the market anticipates a slight increase, a higher-than-expected result could lead to more volatility for risk assets, including cryptocurrencies.”

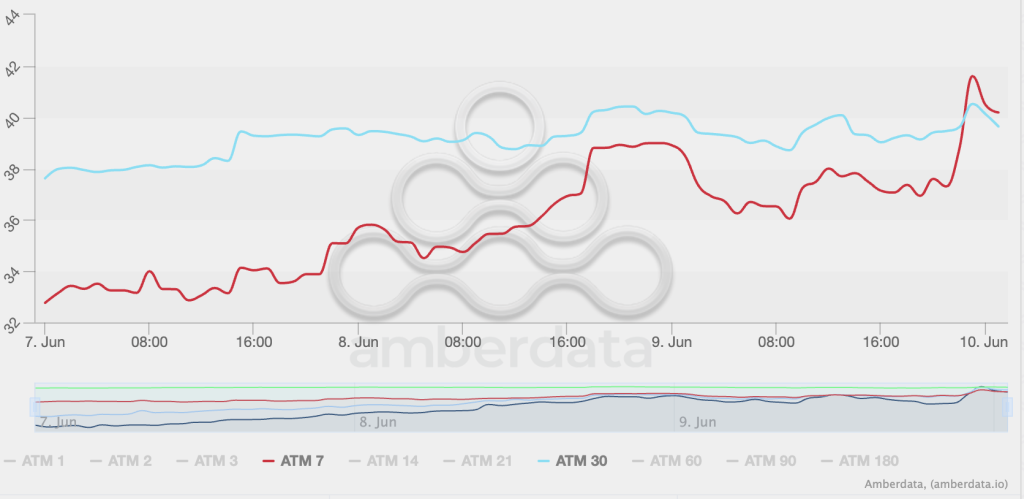

Sean Dawson from Derive.xyz mentioned that despite the recent price rise, implied volatility for BTC is still at its yearly lows. He explained that this might indicate “considerable mispricing, giving traders a chance to secure inexpensive upside leverage or downside protection.”

BTC 7-day (red) and 30-day (cyan) implied volatility.

Dawson pointed out that the low reaction of implied BTC volatility, even with the price increase, suggests “a potential disconnect between market valuation and underlying risk. This presents a strategic opportunity for traders to take advantage of relatively low-cost options, allowing for efficient positioning for more gains or potential downturns in BTC.”

Levels & Events to Watch Next

As of now, BTC is trading at $109,531, just below the all-time high of $111,814 set on May 22. The coin attempted to break the $110,200 mark again today, reaching a peak of $110,237 but was unable to hold that level. Should it break the all-time high again, it will then attempt to surpass key resistance levels of $115,103 and $118,358.

During the same time frame, Ethereum reached an intraday high of $2,821, followed by a slight pullback while gradually climbing overall. It has surpassed the resistance level of $2,720, indicating potential future increases.

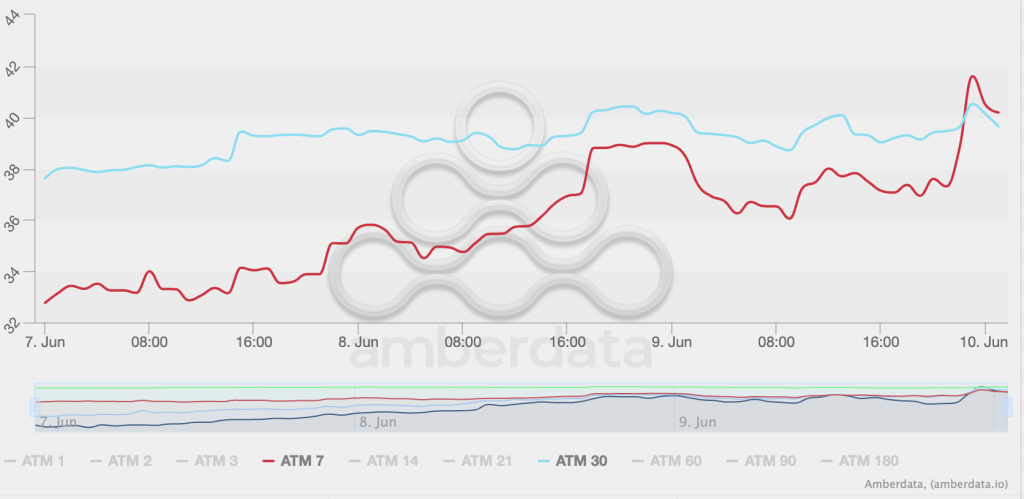

According to Sean Dawson, the volatility for ETH has increased nearly 5% to 70% for 7-day volatility, while sitting at 66% for 30-day volatility. This suggests that daily ETH price fluctuations “could be about twice as significant as BTC’s,” he posited.

ETH 7-day (red) and 30-day (cyan) implied volatility

Additionally, the overall sentiment in the cryptocurrency market continues to improve after entering the greed zone yesterday. The Crypto Fear and Greed Index is currently at 65, indicating a growing bullish attitude with investors actively buying in.

In another development, US spot Bitcoin exchange-traded funds (ETFs) reported a net inflow of $431.12 million on Tuesday. BlackRock’s

The largest contributor to this total was $336.74 million, bringing the overall net inflow to $45.06 billion so far.

Additionally, US ETH spot ETFs have seen inflows for seventeen consecutive days, accumulating another $124.93 million. BlackRock has once again led the way with $80.59 million on June 10. Ultimately, Ethereum investment products have experienced a total net inflow of $3.5 billion.

On another note, Bitcoin continues to attract significant investor attention, with more than 80 publicly traded companies now owning BTC. However, there are some concerns being raised.

A recent report from the global digital asset bank Sygnum states that “large concentrated holdings are a risk for any asset.” Currently, the Strategy’s holdings are ”nearing a point of concern, as the company possesses nearly 3% of all Bitcoin ever created, while holding a significantly larger share of the liquid supply.”

The company aims to acquire 5% of the total issued BTC, which “raises some alarms.” Firstly, accumulating too much of the supply may undermine Bitcoin’s status as a safe haven. Secondly, if private companies dominate a significant part of the available supply, it could make BTC unsuitable for central banks as a reserve asset, according to Sygnum. Lastly, a drop in liquid supply may deter large institutional investors.

Quick FAQ

- What caused crypto to move with stocks today?

Both the crypto and stock markets have shown gains in the past day, although crypto’s rise is notably more significant. For instance, the S&P 500 has climbed by 0.55%, the Nasdaq-100 is up 0.66%, and the Dow Jones Industrial Average increased by 0.25%. Stock prices have risen for three consecutive days, and today’s changes are expected to react to the agreement reached during US-China trade negotiations.

- Is this rally likely to last?

The current two-day rally is being fueled by a positive market sentiment. Analysts believe the market may continue to rise, but they advise traders and investors to monitor macroeconomic and geopolitical developments closely.

The post Why Is Crypto Up Today? – June 11, 2025 appeared first on Cryptonews.