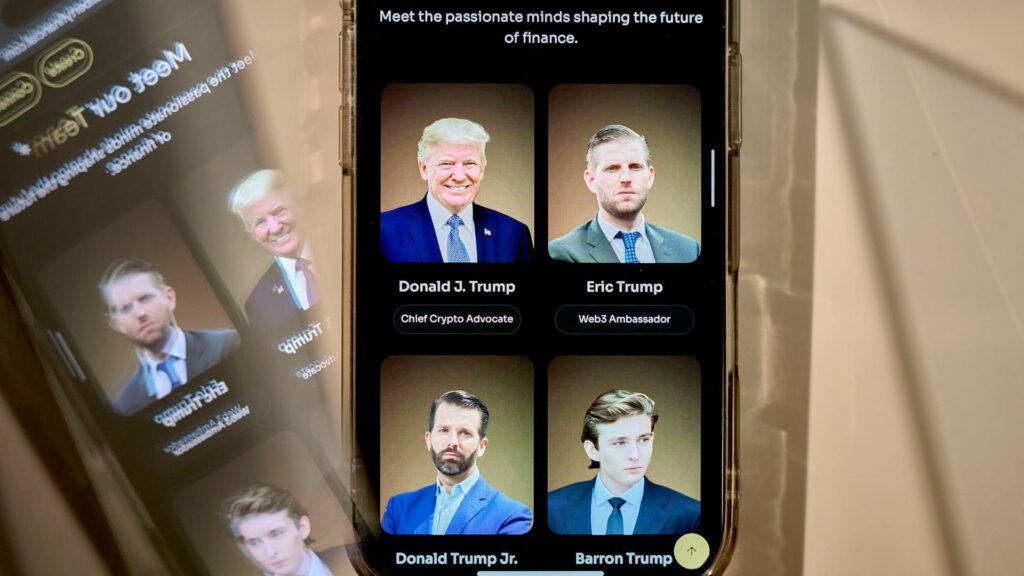

The World Liberty Financial website displayed on a smartphone in New York, US, on Wednesday, February 12, 2025.

Gabby Jones | Bloomberg | Getty Images

On Tuesday, the Senate approved the GENIUS Act, a groundbreaking piece of legislation that introduces federal regulations for U.S. dollar-pegged stablecoins for the first time and establishes a formal process for private firms to create digital dollars with government support.

The bill received a 68-30 vote in favor.

This moment marks a significant achievement for the cryptocurrency sector and for President Donald Trump’s extensive digital asset interests.

This represents the initial legislative success for the digital asset sector, which invested around $250 million during the 2024 election cycle to support what is now seen as the most pro-crypto Congress in U.S. history.

“The GENIUS Act will safeguard consumers, foster responsible innovation, and protect the U.S. dollar’s global position,” stated Senator Kirsten Gillibrand, D-N.Y., who co-sponsored the bill, after its approval.

Although the House, which is controlled by Republicans, poses some challenges for the bill, its passage in the Senate indicates a pivotal shift not just for the technology but also for the political influence behind it.

The full title of the GENIUS Act is the Guiding and Establishing National Innovation for U.S. Stablecoins Act, and it sets up regulations for the industry, including full reserve backing, monthly audits, and measures against money laundering.

Additionally, it paves the way for a wider array of issuers, such as banks, fintech companies, and large retailers that want to launch their own stablecoins or integrate them into current payment systems.

The bill provides broad authority to Treasury Secretary Scott Bessent, who stated last week in a Senate subcommittee hearing that the U.S. stablecoin market could expand nearly eight times to over $2 trillion in the coming years.

“Stablecoin legislation supported by U.S. Treasuries or T-bills is poised to establish a market that will widen the global use of the U.S. dollar through these stablecoins,” Bessent remarked.

The GENIUS Act is now headed to the House, which has its own version of a stablecoin bill known as STABLE. Both versions prohibit yield-earning consumer stablecoins, but differ in their regulatory frameworks.

The Senate’s approach centralizes regulation under the Treasury, while the House divides authority among the Federal Reserve, the Comptroller of the Currency, and other entities. Aligning the two could take time, according to Congressional staff.

Initially, the GENIUS Act was expected to be an easy cryptocurrency bill to pass, but it took months to reach the Senate floor, faced initial rejection, and eventually passed only after intense negotiations.

“We believed starting with stablecoins would be simple,” said Senator Cynthia Lummis, R-Wyo., during a presentation at this year’s Bitcoin 2025 conference, which majorly focused on stablecoins.

“This has proven to be extremely challenging. I underestimated how tough this would be,” she admitted.

At the same event, Senator Bill Hagerty, R-Tenn., shared similar frustrations: “It has been incredibly difficult to get them there,” he remarked regarding the 18 Senate Democrats who ultimately supported the bill.

Transforming Traditional Payment Systems

Stablecoins are a specific category of cryptocurrencies that are tied to the values of tangible assets. Approximately 99% of stablecoins are pegged to the U.S. dollar.

The advantage of stablecoins is clear: they facilitate immediate transactions and reduce fees, eliminating intermediaries and posing a direct challenge to traditional payment systems.

Shopify has already implemented USDC-based payments through Coinbase and Stripe. The CEO of Bank of America mentioned last week at a Morgan Stanley conference that they are engaging in discussions with the industry and are examining options for stablecoin issuance.

Payment stocks such as Visa,

Mastercard, PayPal, and Block experienced declines after a report from The Wall Street Journal indicated that Amazon and Walmart are considering the development of their own stablecoins.

This development has fueled a significant stock rise for Circle, whose shares have skyrocketed 400% since going public on June 5.

According to Deutsche Bank, stablecoin transactions reached $28 trillion last year, which was more than the combined totals for Mastercard and Visa.

However, there are some limitations. The GENIUS Act prevents major non-financial tech companies from issuing stablecoins directly unless they establish a partnership with regulated financial institutions, addressing monopoly concerns.

JPMorgan is taking an alternative approach by launching JPMD, a deposit token that behaves like a stablecoin but is closely tied to traditional banking systems.

JPMD, which is issued on Coinbase’s Base blockchain, is exclusively available to institutional clients and offers features like around-the-clock settlement and interest payments. This move is part of a larger effort by established financial institutions to adapt to the stablecoin landscape while retaining competitiveness against crypto-native companies.

Trump’s Stake

Although Democrats sought modifications to the bill to prevent the president from benefiting from cryptocurrency activities, the final law only restricts Congressional members and their families.

Trump’s initial financial disclosure as president, made public on Friday, showed that he generated at least $57 million in 2024 from token sales associated with World Liberty Financial, a cryptocurrency platform closely related to his political initiatives.

He possesses nearly 16 billion WLFI governance tokens — comparable to voting shares in the cryptocurrency realm — which could potentially be valued around $1 billion, based on past private transactions.

This is just a portion of Trump’s overall crypto portfolio.

The family’s ventures include the controversial $TRUMP meme coin, a $2.5 billion Bitcoin treasury, proposed Bitcoin and Ether ETFs through Truth.Fi, and a recently established mining operation named American Bitcoin, indicating a strong push into the digital finance sector.

Forbes has recently valued Trump’s cryptocurrency holdings at nearly $1 billion, raising his total net worth to $5.6 billion.