On Monday, under the guidance of Executive Chairman Michael Saylor, Strategy revealed that it has expanded its Bitcoin reserves by acquiring 1,045 BTC at an estimated cost of $110.2 million.

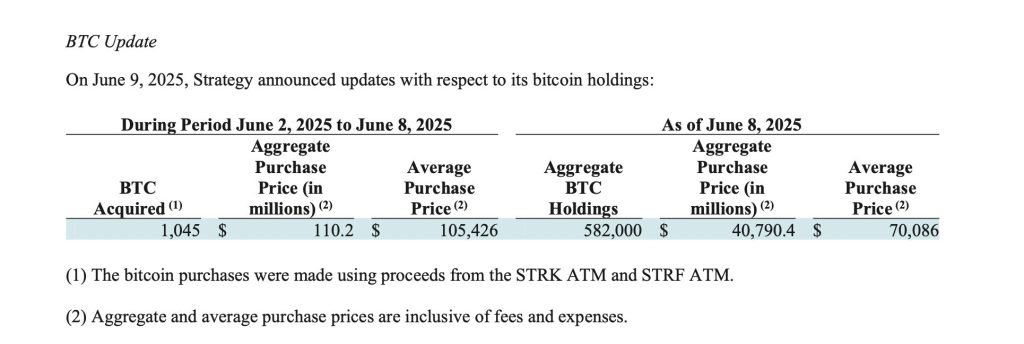

This recent acquisition, shared in a U.S. Securities and Exchange Commission (SEC) filing on June 9, 2025, was executed at an average rate of $105,426 per Bitcoin, coinciding with Bitcoin’s approach to its all-time high (ATH).

This action signifies the ninth consecutive week that the company has bolstered its Bitcoin holdings, reinforcing its assertive accumulation tactics.

Strategy’s Bitcoin Holdings Now Exceed $40 Billion

Following this latest acquisition, Strategy’s total Bitcoin assets have climbed to around 582,000 BTC. The firm has invested roughly $40.79 billion into this cryptocurrency portfolio, averaging about $70,086 per Bitcoin.

As Bitcoin hovers near record prices, Strategy’s assets are not only significant in volume but also likely to yield high returns—especially considering the company’s strategic and consistent purchasing approach throughout various market fluctuations.

Under the leadership of Michael Saylor, Strategy has become the foremost corporate holder of Bitcoin, with its BTC investment strategy becoming an integral aspect of its identity, attracting both institutional interest and market scrutiny.

Growing Institutional Confidence in Bitcoin

This latest purchase signifies more than just optimistic market sentiment; it showcases an emerging institutional trust in Bitcoin’s long-term potential. Strategy’s continuous acquisitions suggest that it sees BTC as a vital treasury asset, akin to digital gold.

By persistently engaging in market offerings and channeling proceeds into Bitcoin, the company reinforces its belief that Bitcoin will continue to rise in value and outshine conventional assets over time.

As the crypto landscape evolves and regulatory clarity gradually increases, Strategy’s actions may motivate other businesses to explore similar asset allocation strategies.

Saylor’s Intriguing ‘Send More Orange’ Message

On Sunday, Saylor shared a graphic displaying the company’s BTC holdings, indicating Strategy’s intention to ramp up its Bitcoin purchases with the phrase, “Send more Orange,” which is popularly recognized as a Bitcoin symbol in the crypto community.

Saylor often makes announcements on Sundays preceding his Bitcoin acquisitions. However, a recent K33 Research report suggested that Strategy (formerly known as MicroStrategy) appears to be slowing its Bitcoin purchases. K33 Research Head Vetle Lunde noted that this might be due to a waning premium for MSTR shares compared to the firm’s Bitcoin assets.

The post Michael Saylor’s Strategy Scoops 1,045 BTC for $110M – Trove Tops $40B Near Record Highs appeared first on Cryptonews.