Dogecoin has made a comeback in the news, fueled by recent activity from large holders and a wave of optimistic forecasts suggesting a breakout could soon push it above the challenging $0.20 level.

In just the last week, significant investors have added an impressive 100 million DOGE to their holdings, creating buzz about a possible rally.

This development coincides with growing confidence from both individual and institutional investors, including a notable endorsement from 21Shares, a prominent crypto research firm and ETP issuer.

A recent post by JustDoIt on CoinMarketCap captured the prevailing mood clearly:

While a $5 target might seem overly ambitious to some, there is a growing belief that DOGE’s prospects could be brighter than anticipated.

On April 30, 21Shares released an in-depth research note claiming that Dogecoin has evolved beyond just a joke.

The firm noted that DOGE can now be seen as “a sensible addition to your portfolio,” presenting data that shows enhanced returns and Sharpe ratios when a typical 60/40 portfolio includes a small allocation to DOGE.

The findings indicate that even a 1% stake in DOGE might elevate average yearly returns to 8.95%, while keeping drawdowns manageable.

Furthermore, the research proposed three potential future scenarios for Dogecoin’s price movements.

In a pessimistic scenario, if it achieves a modest annual growth of 10% from its peak in 2021, DOGE could reach $0.38 by 2025.

In a neutral scenario, if Dogecoin maintains its position as the leading memecoin in a $5 trillion crypto market, its value could approximate $1.

For the optimistic scenario, 21Shares sees potential for DOGE to soar to $1.42 if it can replicate its past compounded growth, driven by a resurgence in memecoin enthusiasm, practical usage, and platform integration, particularly with Elon Musk’s X.

Whale Watch and Short-Term Analysis: DOGE’s Upcoming Prospects

While the long-term outlook is intriguing, the immediate prospects for Dogecoin are equally engaging.

After a nearly 15% increase over the last two weeks, DOGE hit a temporary peak of $0.19 on April 26, before settling back to approximately $0.18.

Technical analysts believe this recent trend may have successfully broken past the $0.175 resistance level.

Trader Tardigrade noted that DOGE’s rise above $0.175 signals a breakout that could propel the token beyond $0.20 in the near future.

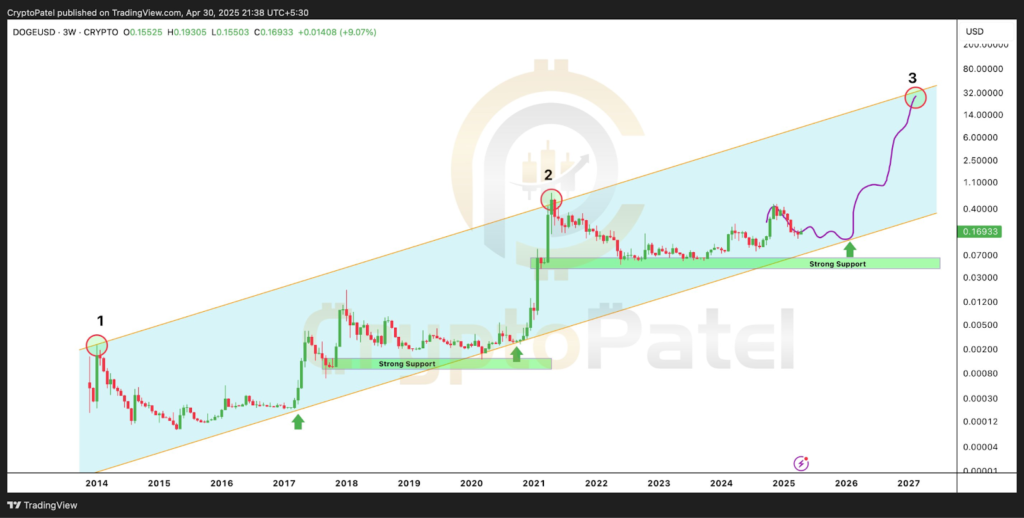

CryptoBullet echoed this assessment, suggesting that DOGE is forming a classic “accumulation cylinder,” a pattern that has historically led to a significant upward movement.

They forecast a potential peak cycle price of $3.20, with a return to current levels expected by 2027.

Whale activity is an encouraging bullish sign. According to Ali Martinez, large DOGE holders (with 1M–10M DOGE) purchased 100M tokens this week, boosting their total holdings to over 10.5 billion DOGE, which is about 7% of the total circulating supply.

This accumulation pattern typically draws interest from retail buyers and decreases the overall market supply, setting the stage for potential price increases.

However, with the accumulated DOGE valued at less than $20 million, some critics argue that this alone may not trigger a significant price surge.

Can DOGE Overcome Resistance or Will It See Another Decline?

Even with optimistic feelings in the market, Dogecoin has to overcome significant challenges before making a clear breakout.

After reaching $0.1920, DOGE fell back, dropping below essential support at $0.1750.

Data from Cryptonews indicates that the token is currently trading below its 100-hour simple moving average and is forming a bearish trend line, facing resistance at $0.1740.

From a technical standpoint, DOGE needs to surpass $0.1800 and close above the $0.1850 mark to maintain positive momentum.

A rise above $0.1920 would lead to testing the significant psychological resistance at $0.20. After that, the next crucial targets would be $0.1980 and $0.2000.

On the downside, the first support level is found at $0.1700, followed by $0.1680. If DOGE fails to hold these points, it could decline further towards stronger support levels at $0.1600, or possibly $0.1550 and $0.1450 in a prolonged downturn.

That being said, technical indicators show a mixed outlook. The MACD is losing bearish momentum, and the RSI is slightly above 50, indicating mild bullish tendencies.

As the market seeks direction, the narrative around Dogecoin is evolving. Whether it will break above $0.20 soon or enter another consolidation phase, DOGE is increasingly perceived as a long-term viable option.

The post Dogecoin Whales Purchase 100M DOGE in a Week, Boosting $0.20 Breakout Expectations appeared first on Cryptonews.

Read the full breakdown: https://t.co/bKh0SEBJgv

Read the full breakdown: https://t.co/bKh0SEBJgv