Starting off: Latham & Watkins is preparing to recruit a prominent dealmaker from Wachtell Lipton. This move is part of the Los Angeles-based law firm’s strategy to enhance its corporate practice to rival its competitors in New York.

New venture from Musk: Linda Yaccarino, CEO of X, announced that users will soon be able to invest or trade via the social media platform. This is part of owner Elon Musk’s initiative to create an “everything app” that encompasses financial services.

Moreover: Risk advisory firms have reported a “significant rise” in inquiries as companies in the Gulf prepare contingency measures and activate crisis teams in anticipation of possible repercussions from the Israel-Iran conflict.

Welcome to Due Diligence, your update on dealmaking, private equity, and corporate finance. This article serves as an on-site version of the newsletter. Premium subscribers can register here to receive newsletters from Tuesday to Friday. Standard subscribers have the option to upgrade to Premium here, or to explore all FT newsletters. Feel free to reach out to us at any time: Due.Diligence@ft.com

In today’s newsletter:

Lutnick promotes the ‘Trump Card’

TSB is back on the market

The journey from worldwide scandal to IPO

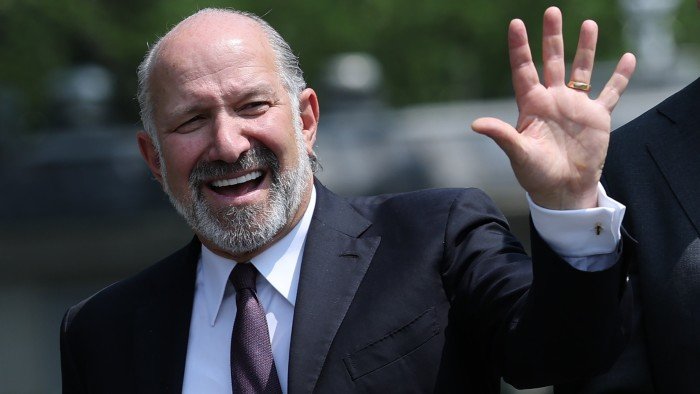

FT’s conversation with Howard Lutnick

Howard Lutnick called Monday morning to present the “Trump Card”: a $5 million visa providing legal residency for foreigners in the US.

The US commerce secretary informed the FT that he discreetly encouraged foreign dignitaries during his Middle East visit to purchase the visa.

Last week, he launched a website — trumpcard.gov — for those interested.

During the call with FT’s Alex Rogers on Monday, he mentioned that 67,697 individuals had signed up for the waiting list and later noted that the number had risen to 68,703.

Lutnick believes the Trump Card — which he suggested would be made from gold — could generate significant revenue for the US Treasury and attract international business leaders along with their skilled workers to America.

However, the commerce department has not provided detailed information. It is purportedly planning to sell tens of thousands of visas this summer, even though the program currently consists solely of a landing page.

The specifics are still vague, particularly concerning favorable tax structures and vetting processes which have yet to be clarified publicly.

It remains unclear how the Trump Card will affect the cheaper EB-5 investor visa established decades ago by Congress.

Despite these uncertainties, Lutnick — a tenacious banker and Trump advisor, who founded Cantor Fitzgerald — remains enthusiastic.

“Whenever I meet international executives, I always discuss it and promote it,” Lutnick shared with the FT. “I can’t resist.”

Banks eye TSB

After BBVA launched a €11 billion hostile takeover bid for its competitor Sabadell over a year ago, it opened the door for Sabadell-owned UK bank TSB to potentially return to the market.

This week, that possibility grew more tangible when FT’s Simon Foy and DD’s Ivan Levingston reported that Sabadell is considering selling TSB due to unsolicited offers.

Potential bidders are expected to present their offers this month, with the FT also reporting on Wednesday that the UK’s NatWest has opted against bidding for TSB, while Barclays and Santander are among those exploring an acquisition.

TSB has changed ownership multiple times. Established as the Trustee Savings Bank in 1810, TSB merged with Lloyds Banking Group in 1995, only to be separated from it due to a government bailout during the financial crisis.

It subsequently went public on the London Stock Exchange in 2014, with the aim of challenging the dominance of major UK banks in the retail sector.

They eliminated internal sales targets and offered clients better interest rates “without the gimmicks,” before being acquired by Sabadell in a £1.7 billion deal less than a year afterward.

A potential deal for TSB would represent the latest in European banking activities, which have seen a surge of transactions and attempted acquisitions over the last year.

Any prospective new owner will hope for a smooth transition. When TSB switched from Lloyds’ legacy systems to Sabadell’s IT infrastructure in 2018, it resulted in 2 million customers being temporarily locked out, costing the bank £49 million in fines.

The Batista brothers make a comeback

They transformed their family slaughterhouse into the world’s largest meatpacking firm, only to fall from grace amid a corruption scandal.

Now Brazil’s billionaire barons of butchery are back.

The brothers Joesley and Wesley Batista celebrated their triumphant comeback last week as the company they lead, JBS, finally listed its shares on the New York Stock Exchange, achieving a decade-long aspiration.

This marks a significant comeback for the controversial pair, who built their meat processing empire through global acquisitions early in the century before facing downfall less than a decade ago after admitting to multi-million dollar bribes to politicians in Brazil. They served time in prison and nearly brought down a president.

After years in obscurity, the brothers are again mingling with top politicians and business leaders in Brazil. However, their return has increased scrutiny on them.

The proposal for listing in the US faced opposition from a group of environmentalists and ranchers, who accused JBS of contributing to Amazon deforestation.

Opposition lawmakers in Brasília also allege that an energy company within the Batista family business empire received favorable treatment from the leftist government of Luiz Inácio Lula da Silva.

The Batista family holding company, J&F Investimentos, firmly denies these claims, as does the administration.

Despite the likelihood of the Batistas enhancing their control at JBS following the New York listing, minority shareholders were ultimately convinced by the argument that it will increase share value.

“It’s crucial for them to be back in the game,” stated a source familiar with the brothers. “This is what they thrive on.”

Check out FT’s in-depth analysis of the Batistas.

Career updates

Blackstone has appointed Laura Coady as the new global head of CLOs in London, according to Bloomberg. She was previously with Jefferies.

Trafigura’s head of strategic projects, Julien Rolland, is set to retire from the commodities trading firm, marking another prominent exit from the global group since Richard Holtum.

assumed the role of chief executive.

Akin Gump has brought on board M&A partner Joshua La Vigne and investment management partner Jessica Pan, both formerly of Mayer Brown.

Engaging Reads

Inner Fighter Mark Zuckerberg has shifted into a more assertive “Maga Mark,” according to FT Magazine, surprising many liberals at Meta. But was he always this way?

Solar Armageddon Republicans have quickly suggested scaling back renewable energy investments, as reported by the FT. Bankruptcies have already begun.

The Big Tech Divide The emergence of artificial general intelligence is anticipated as the next significant innovation from Silicon Valley, the FT notes. But is it truly a scientific target—or just a marketing tactic?

News Highlights

France plans to increase its investment in Eutelsat as Europe seeks a competitor to Elon Musk’s Starlink (FT)

A former Janus Henderson analyst has been convicted of insider trading while working from home (FT)

The UK government denies Thames Water creditor demands as administration approaches (FT)

Lockheed Martin presents an air defense proposal to the UK government (FT)

Wall Street relies on stock traders to mitigate the slowdown in dealmaking (FT)

Due Diligence is authored by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, Alexandra Heal, and Robert Smith in London, along with James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard, Maria Heeter, Kaye Wiggins, Oliver Barnes, Jamie John, and Hannah Pedone in New York, and George Hammond and Tabby Kinder in San Francisco, with Arjun Neil Alim contributing from Hong Kong. Feedback can be sent to due.diligence@ft.com

Suggested Newsletters for You

India Business Briefing — Essential reading for Indian professionals on business and policy in the world’s fastest-growing major economy. Subscribe now

Unhedged — Robert Armstrong analyzes the pivotal market trends and explores how Wall Street’s top experts react to them. Subscribe now