Summary

- China has become a significant financial partner for African countries, with loan commitments totaling $182.28 billion from 2000 to 2023.

- By 2020, Chinese lenders made up about 12% of Africa’s overall external debt, which had reached $696 billion.

- Since gaining independence, African nations have seen their loan debts skyrocket, with total external debt estimated at $1.1 trillion in 2022.

In-Depth Analysis

Following independence, numerous African countries have encountered serious financial issues primarily related to external debt. Once a rare occurrence, sovereign debt defaults are now more common due to global economic shocks, poor management, political unrest, and fragile economic frameworks.

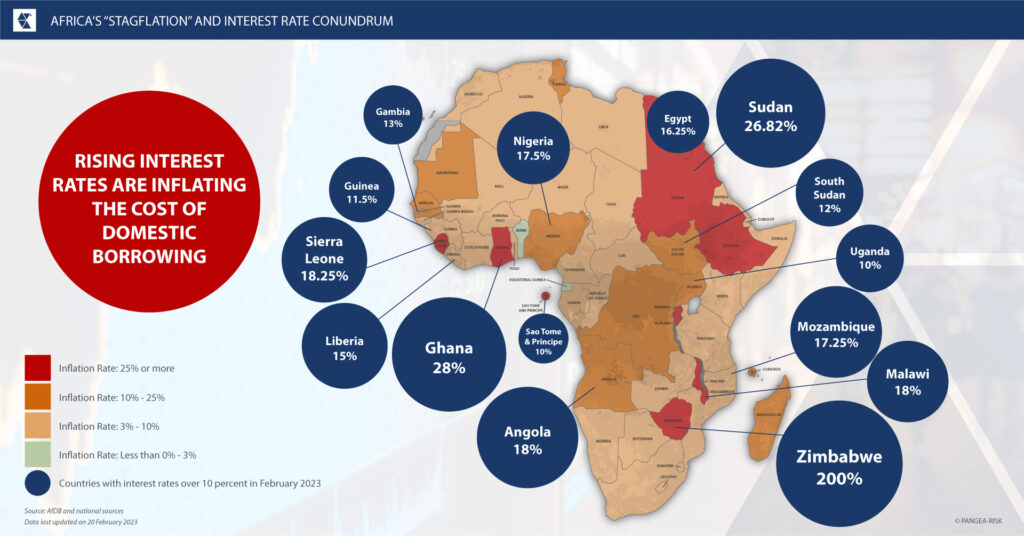

Post-independence, concerns over foreign debts and sustainability have grown as African governments struggle with increasing interest payments, inflation, currency depreciation, and decreasing foreign reserves.

This debt predicament has been worsened by global economic disruptions, including financial crises, the COVID-19 pandemic, and the Ukraine conflict, as well as intrinsic weaknesses in African economies. There has also been a notable shift in the debt structure, with commercial debts gaining prominence and bilateral debts declining.

This article explores the ten African countries that have defaulted on their sovereign debt since independence, providing an overview of the historical background, reasons, and repercussions of each instance. Understanding these defaults offers vital insights into Africa’s financial situation and ongoing endeavors for economic stability and prudent borrowing practices.

10. Burkina Faso / Mali (Post-2020)

Political coups and sanctions from entities like the UN, ECOWAS, and the EU led to Burkina Faso and Mali halting debt payments. This default reflects the growing risks of governance-related issues in fragile countries. However, payments resumed after sanctions were lifted.

9. Cameroon (2004, 2007)

Cameroon defaulted on its external debt in 2004 and 2007 due to pre-HIPC debt distress. Nevertheless, it managed to restructure its $480 million bond and emerge from default through successful debt forgiveness agreements.

8. Niger (2023)

In 2023, a military coup in Niger led to a suspension of repayment on a $51 million Eurobond due to sanctions imposed by ECOWAS. This resulted in regional isolation and asset freezes, leaving the country uncertain about debt resolution.

7. Zimbabwe (2000s–present)

Zimbabwe has not met its foreign debt obligations since the early 2000s due to hyperinflation, poor governance, and currency failure. This default has led to a collapse in public services and economic upheaval.

6. Sudan (2002, 2022)

Sudan experienced debt defaults in both 2002 and 2022, caused by internal turmoil and international sanctions. These sanctions hindered the country’s ability to pay back around $22.1 billion in Paris Club debt, resulting in stalled economic recovery and a lack of political stability.

5. Côte d’Ivoire (2011)

The post-election turmoil in Côte d’Ivoire in 2011 led to a missed interest payment of $29 million on a Eurobond. However, the country quickly regained investor confidence by issuing a restructured bond worth $2.3 billion.

4. Mozambique (2016)

The 2016 uncovering of a $2 billion hidden loans scandal resulted in the IMF blacklisting Mozambique, pushing the nation into a debt crisis. The debt-to-GDP ratio surged to about 101%, but restructuring was completed by 2019.

3. Ethiopia (2023)

After the civil war and depletion of reserves, Ethiopia defaulted on a $33 million coupon payment for a $1 billion Eurobond in 2023. To mitigate the impact, the country joined the G20 Common Framework for debt restructuring, which is currently in progress.

2. Ghana (2022)

In 2022, Ghana ceased servicing its $28.4 billion external debt amid an economic crisis. However, the country reached an agreement for an IMF bailout, dedicating over 70% of its revenue to debt repayment.

1. Zambia (2020)

Zambia’s failure to pay a €42.5 million Eurobond in 2020 marked the first notable default during the COVID era in Africa. The debt-to-GDP ratio soared to 140% due to costs associated with infrastructure and the pandemic. In 2024, the country achieved its first successful restructuring through the G20/IMF Common Framework.