Access the Editor’s Digest for no cost

Roula Khalaf, Editor of the FT, curates her top stories every week in this newsletter.

This article is an on-site version of our Unhedged newsletter. Premium subscribers can sign up here to receive the newsletter every weekday. Standard subscribers can switch to Premium here, or check out all FT newsletters.

Good morning. While the story surrounding Trump’s tariffs continues, the AI narrative persists as well. Microsoft revealed a 20% growth in its Azure sector, fueled by the demand for AI services. Both Microsoft and Meta have committed to significant investments in data centres. Perhaps we can shift our focus from the White House for a few days? Reach out to us at: robert.armstrong@ft.com and aiden.reiter@ft.com.

GDP: before and after

Many indicators of the US economy resemble the “before” section of those advertisements for anti-aging products, liposuction, or dandruff solutions. We’re waiting for the “after” results, which aren’t obtainable yet. Thus, we need to analyze the “before” aspects carefully and make educated predictions about the miracle’s impact.

The miracle treatment in question is Donald Trump’s high tariff policies, enacted on April 2, marking the onset of the second quarter. This date influences the initial quarter GDP report released yesterday.

However, the report was surprisingly positive. The “before” results appear quite promising.

Though headline growth posted a decline of 0.3%, this figure was skewed by an enormous increase in imports, reducing the headline growth by as much as 4.8%. Imports subtract from GDP since they are not domestically produced (hence “gross domestic product”) to prevent counting them twice in consumption and investment. If the surge in imports during Q1 was indeed driven by demand, it should settle over time.

Before diving into the implications of the import surge, let’s highlight the robust elements of the report. Real household consumption, the key driver of the US economy, rose by 1.8%, while real final sales to domestic purchasers—which includes consumer spending and fixed private investment excluding inventories—grew by 3%. This is quite a relief, especially considering the poor consumer and small business sentiment surveys from recent months.

However, interpreting investment data becomes convoluted. Private investment experienced a remarkable 22% annualized growth from the preceding quarter. Most of this increase stemmed from a notable rise in computer equipment purchases, which almost single-handedly added a full percentage point to GDP. This surge appears to be largely due to companies hastening to meet their long-term needs from global suppliers ahead of tariffs. But to what extent? And how much stems from sustained demand in the AI sector? The uncertainty surrounding these factors significantly impacts our understanding of the economy’s true strength.

The report also indicated that concerns about tariffs influenced demand elsewhere. Yet, interpreting these figures is tricky. A substantial buildup of business inventories contributed over 2 percentage points to GDP. In a footnote, the Bureau of Economic Analysis noted: “The estimates of private inventory investment were derived mostly from Census Bureau inventory value data, with adjustments by the BEA in March for a notable uptick in imports.” Our colleague Chris Giles clarified this: there is concrete data on the increase in imports that can be directly counted as they arrive at the ports. Conversely, the inventory figures rely heavily on models and estimates, which utilize the surge in imports as an input. This suggests that actual consumption might be considerably higher or lower than the reported numbers, which could alter our growth assessment.

A critical aspect to note in the report: inflation. The core personal consumption expenditures price inflation, the Federal Reserve’s preferred metric, decreased slightly both monthly and annually but remains above the targeted level at an annual rate of 2.6%.

To summarize: consumption growth remains steady, although not accelerating; business investment appears strong, but the impact of tariffs obscures the overall view; and inflation, while declining, has not yet reached the desired level. This suggests to us that the Fed may maintain rates during next week’s meeting and possibly for an extended period (the futures market anticipates four rate cuts of 25 basis points by year-end, with six meetings remaining).

So, we have a promising “before” picture. What, if anything, can we discern about the “after”?

We have ample reasons to believe that consumer activity has remained robust since April 2. On Tuesday, Visa announced a 6% growth in payment volumes across its US operations for the first quarter, consistent with recent quarters, and volumes even saw a slight uptick in the initial weeks of April. Here’s a quote from the CEO:

We have not detected any signs of overall consumer spending weakening. While growth varies among consumer categories, with the most affluent spending the most, all groups are displaying resilience similar to past quarters. Certain sectors like travel, particularly airlines and lodging, have seen a slowdown, but general discretionary and non-discretionary spending remains strong.

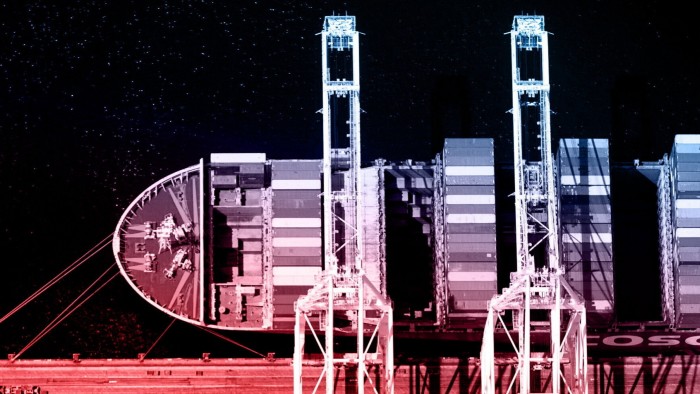

However, consumers have yet to experience the repercussions of tariffs in terms of increased prices or scarce products. Most businesses have not faced tough decisions about whether to absorb tariff costs, pass them to customers, or stop importing particular items. Many still have pre-tariff stock to utilize while hoping for policy changes. Nonetheless, the crucial moment is drawing near at a slow, steady pace akin to a cargo ship. In a recent FT article:

The Port of Los Angeles, the primary entry point for goods from China, expects a 33% drop in scheduled arrivals during the week of May 4 compared to last year, with airfreight services also reporting significant drops in bookings.

Book 20-foot shipping containers from China to the US saw a decrease of 45% compared to a year ago by mid-April, according to container tracking data from Vizion.

Unless there is a significant and swift retreat from tariffs, the “after” snapshot will take full shape by this summer.

One good read

Logos hold significance.

If you want more insights into markets, tariffs, and economic trends, Unhedged and our colleagues discussed the outlook during an FTLive event last week. A video is available here.

FT Unhedged podcast

For more on Unhedged, tune into our new podcast, offering a 15-minute overview of the latest market news and financial headlines, released twice a week. Catch up on earlier editions of the newsletter here.

Recommended newsletters for you

Due Diligence — Key stories from the corporate finance world. Sign up here.

Free Lunch — Your guide to global economic policy discussions. Sign up here.