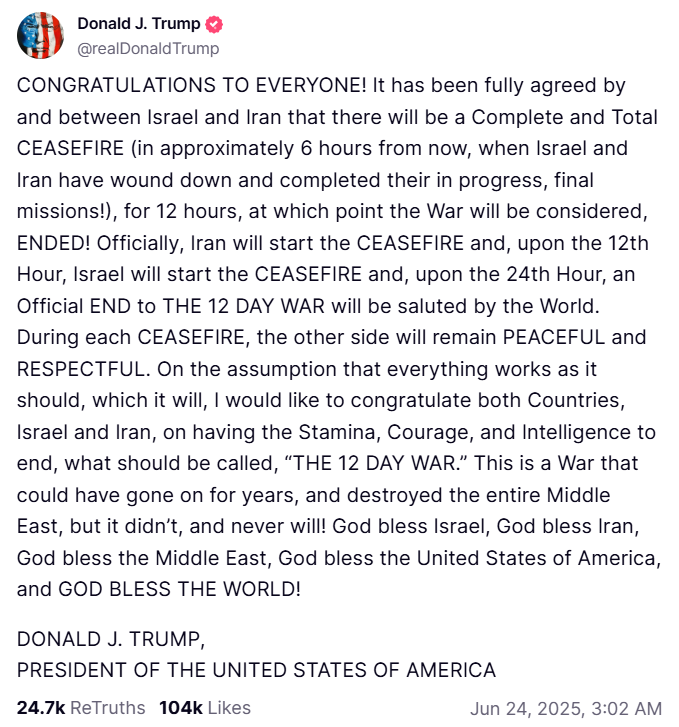

In the early hours of Tuesday, Bitcoin surged past $105,000, showing a remarkable increase of nearly 4.5% in just 24 hours. This boost followed an announcement by U.S. President Donald Trump regarding a complete ceasefire agreement between Israel and Iran.

The agreement, which was reached through Gulf intermediaries and direct discussions between officials from both nations, represents a significant reduction in hostilities after almost two weeks of military actions.

The cryptocurrency market reacted swiftly. With decreasing tensions and traditional safe havens like gold stabilizing, Bitcoin regained its appeal for investors looking for riskier assets. Traders are optimistic that a newfound stability in the region could boost confidence in speculative investments.

Trump mentioned that an early alert from Iran regarding a planned missile strike helped avoid casualties at U.S. bases in Qatar, facilitating the ceasefire. As conflicts eased, investors shifted from cautious strategies back into crypto markets.

Why Peace Boosts BTC and Crypto

Political stability tends to increase the interest in higher-risk investments. Ceasefire agreements, particularly those involving the U.S., often spark rebounds in both stock and cryptocurrency markets.

- Less global uncertainty enhances market trust.

- Traders sell off safe investments like gold and bonds.

- Lower volatility attracts more money into cryptocurrencies.

Bitcoin, often seen as a barometer for global sentiment due to its sensitivity to macro news, may indicate that the return of risk-taking could lead to a wider recovery among altcoins and other digital assets.

Technical Analysis: Bitcoin Aims for Breakout

The outlook for Bitcoin turned positive following its recent rise, moving past the 50-period EMA at $103,806 and creating a strong bullish engulfing pattern.

Key indicators like MACD are showing strong bullish signals, with a wide histogram and crossover signal pointing towards further increases.

Currently, Bitcoin is facing critical resistance around $106,000. This level is a descending barrier based on June’s highs and is a vital area for bulls to watch.

Important Levels:

- Resistance: $106,000, $107,580, $109,041

- Support: $103,965, $102,199, $100,487

Trading Strategies:

- A confirmed breakout above $106K with strong trading volume could push BTC toward $109K.

- A failure to break or a bearish signal at $106K might pull BTC back to $102K.

With daily trading volume exceeding $64.9B and a market cap of $2.09 trillion, Bitcoin remains well-positioned technically and could seize the opportunity for gains if peace holds in the region.

Bitcoin Hyper Presale Exceeds $1.3M—Layer 2 Receives a Meme-Style Boost

Bitcoin Hyper ($HYPER) has successfully surpassed the $1.5 million mark in its public presale, having raised $1,527,516.42 against a target of $1,763,403. With only a few hours remaining before the next price tier, buyers can still grab HYPER at $0.012 per token.

As the first Bitcoin-native Layer 2 solution utilizing the Solana Virtual Machine (SVM), Bitcoin Hyper offers swift, cost-effective smart contracts on the BTC network. It merges Bitcoin’s robust security with the scalability of SVM, fostering high-speed decentralized applications, meme coins, and payments, all featuring low gas fees and smooth BTC integration.

Backed by an audit from Consult, Bitcoin Hyper is designed for reliability, scalability, and performance. More than 91 million $HYPER are already staked, with anticipated post-launch staking rewards up to 577% APY. The token is vital for covering gas fees, accessing dApps, and facilitating decentralized governance.

The presale accepts payments in both cryptocurrencies and cards, and through Web3Payments, there’s no need for a wallet. Blending meme culture with functionality, Bitcoin Hyper is rapidly establishing itself as a potential standout in the Layer 2 space for 2025.

This article was originally published on Cryptonews.