The Bank of Korea, which is the central bank for South Korea, remains skeptical about the idea of creating a won stablecoin, even after a recent discussion with Circle, the issuer of USD Coin (USDC).

According to the South Korean news outlet Newsway, unnamed executives from Circle have met with officials from the Bank of Korea and members of the National Assembly.

During these private meetings, the groups reportedly shared their views on stablecoins. However, sources mentioned they couldn’t disclose specific details about what was discussed.

Bank of Korea: Skepticism Towards Stablecoins

The report highlighted that Circle executives are expected to meet high-ranking officials from the Financial Services Commission (FSC), which is the primary financial regulatory body in the country.

As a new government sets its financial agenda in South Korea post the June 3 election, discussions on stablecoins are gaining traction, attracting interest from global firms.

President Lee Jae-myung has committed to introducing a KRW-pegged coin aimed at facilitating business and international trade.

While trading of USDT and USDC is thriving on South Korean exchanges, some believe that the government should allow financial institutions to use USD-pegged coins for settlements.

On June 10, Min Byung-deok, a lawmaker aligned with the Democratic Party, presented an updated version of his proposal known as the Basic Digital Asset Act.

This revised bill contains essential provisions regarding the use of stablecoins. A public briefing on the proposed legislation occurred on June 17.

Governor Raises Concerns

A source from the domestic crypto industry mentioned to Newsway:

“Global crypto firms are keeping a close watch on developments in South Korea. Circle seems intent on connecting with the National Assembly and financial authorities to enter the local market.”

The source also suggested that the introduction of a KRW stablecoin is “still quite distant,” stating, “We are in the early stages of exchanging opinions.”

However, the Kukmin Ilbo noted that Bank of Korea Governor Lee Chang-yong remains doubtful about the stablecoin plans put forth by the Lee Jae-myung administration.

The governor stated that he “does not oppose” issuing a won stablecoin, but raised concerns that it could lead to an increased demand for dollar-pegged stablecoins.

He elaborated:

“I believe that won-pegged stablecoins are necessary, and I’m not against them being issued. [However] if won stablecoins come into play, they might be easily exchanged for dollar stablecoins, which could heighten the demand for the latter. This may complicate our foreign exchange management.”

Lee Chang-yong also mentioned that the adoption of stablecoins might adversely affect the profitability of commercial banks. He concluded:

“Once we get a consensus among the Ministry of Strategy and Finance, the Financial Services Commission, and other relevant ministries, we plan to refine our policies through inter-ministerial discussions.”

Rising USDT Trading Volumes

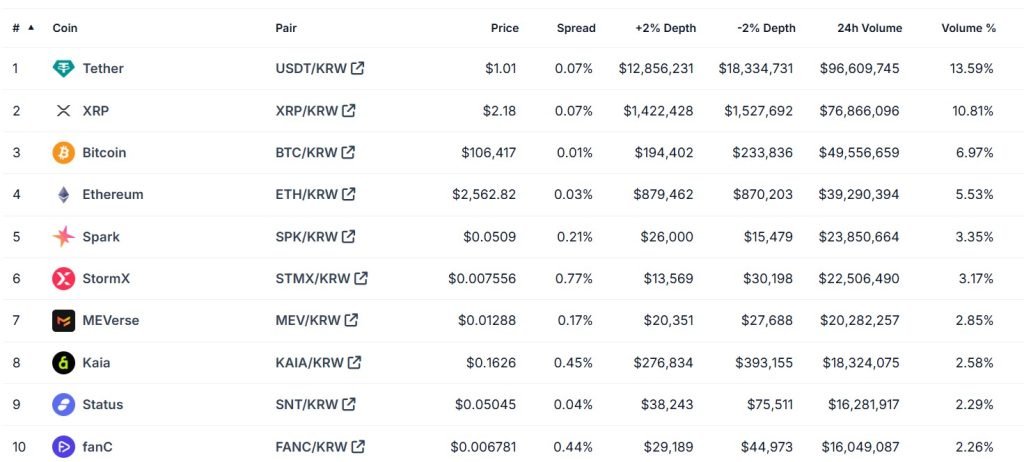

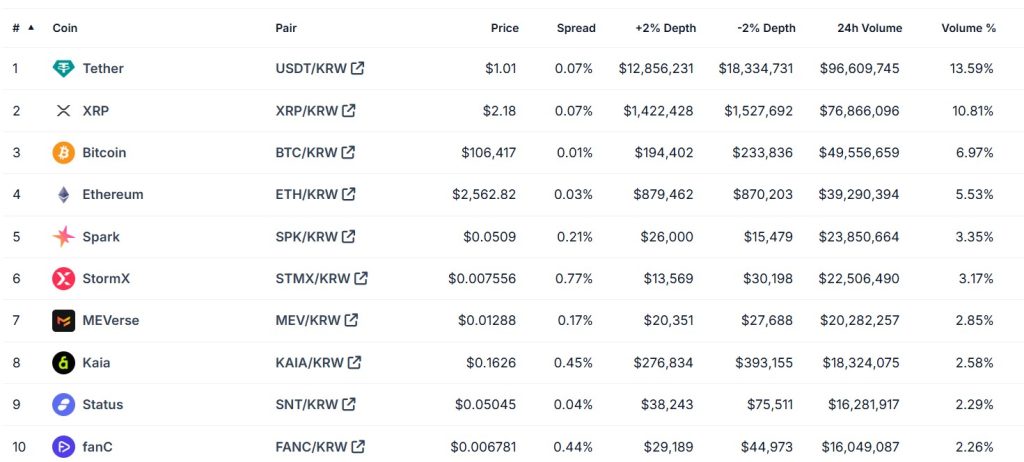

USDT trading volumes continue to rise on South Korean cryptocurrency exchanges. On June 18, Tether’s 24-hour trading volume reached $96,609,745, accounting for nearly 14% of all trades on the platform.

This volume is nearly double that of Bitcoin (BTC) at $49,556,659. Additionally, cryptocurrencies often referred to as “kimchi coins,” linked to stablecoin-related projects, including StormX, fanC, and MEV, are also showing continuous growth.

This article discussed the ongoing skepticism of the Bank of Korea regarding the issuance of a won stablecoin despite interactions with Circle.