The AI model of ChatGPT o3 analyzed 38 live indicators to forecast the price of Cardano. Currently, ADA is priced at $0.5833, with the RSI dropping to 30.76, indicating it’s oversold.

This year, almost $1 billion in ADA was taken out of centralized exchanges, and Ford Motor Company’s involvement in a Cardano-based legal data storage initiative hints at institutional trust, even though the technical indicators suggest weakness.

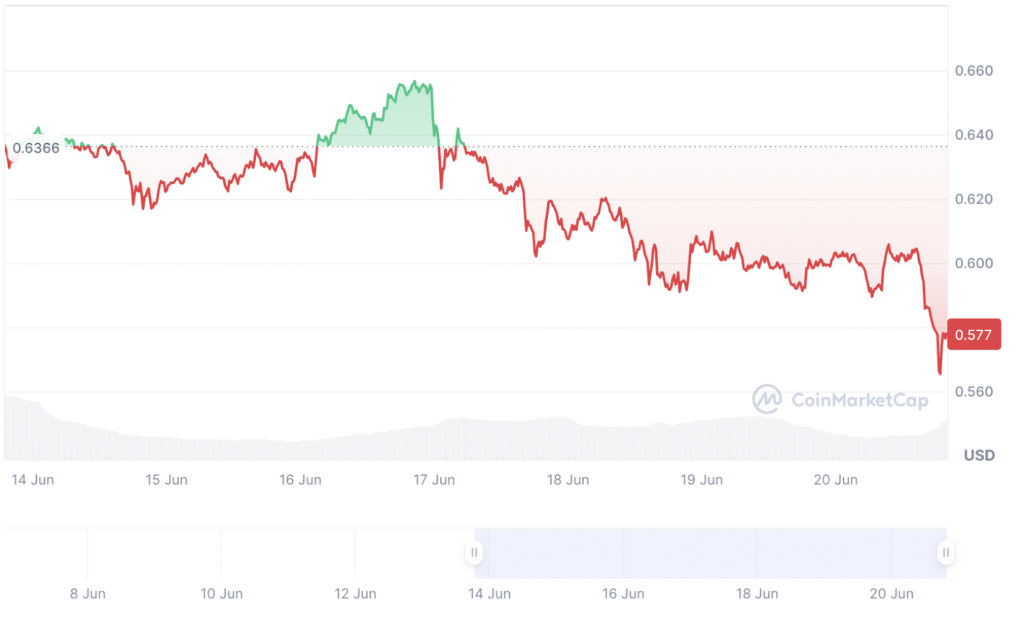

After a 13% drop in seven days, ADA is at a crucial support level of $0.5812, with a daily trading volume of 67.7 million tokens. In June, whales bought 310 million ADA, which may act as accumulation support as technical indicators hit extreme oversold levels.

This analysis was produced using ChatGPT’s o3 AI model, which integrated 38 real-time technical indicators, whale movement data, news of enterprise adoption, and sentiment metrics to estimate ADA’s price trajectory over the next 90 days across various scenarios.

The predictions were revised and combined for clearer readability while retaining analytical accuracy.

Technical Pulse: Extreme Oversold Conditions Meet Volume Surge

Cardano’s daily chart indicates significant technical stress. Currently, ADA is valued at $0.5833, down from an opening at $0.6021, with intraday fluctuations ranging from $0.6071 to $0.5812, a notable 4.3% spread reflecting increased volatility.

With an RSI of 30.76, ADA is firmly in oversold territory, nearing the 30 threshold that historically precedes market rebounds. In the past week, ADA has seen a nearly 13% decline, trading at around $0.60, marking the most oversold status since the capitulation in May.

MACD indicators show a bearish trend, with the MACD line at -0.0065 below the signal line at -0.0311. However, the histogram at -0.0246 indicates a potential divergence in momentum, hinting that selling pressure may be waning, even with ongoing price declines.

Moving averages reveal significant resistance across all timeframes, with the 20-day EMA at $0.6502, 11.5% higher than the current price, while the 50-day EMA at $0.6838 indicates a 17.2% premium.

The 100-day EMA at $0.7063 and the 200-day EMA at $0.7084 come in about 21% above present levels, reinforcing the bearish trend.

Volume analysis shows that 67.7 million ADA were traded daily, a 19% rise from recent averages, suggesting ongoing distribution pressure. However, high trading volume at oversold conditions often precedes market bottoms, especially when aligned with whale accumulation patterns.

The Relative Volatility Index at 37.57 indicates persistent bearish momentum, but is nearing levels that typically signal potential reversals. ATR metrics suggest daily volatility of around 4-5%, which aligns with a current consolidation zone between $0.58 and $0.61.

Historical Price Context: Six-Month Bear Market Trajectory

Cardano’s performance in 2025 displays a steady downturn from a January peak near $1.16. Trading in February ranged between $0.85 and $0.90, followed by a consolidation phase in March with values between $0.80 and $0.85 before a marked decline during spring.

The largest drop occurred in May, where ADA hit around $0.65, followed by a volatile trading range in June between $0.60 and $0.95.

At the beginning of June 2025, ADA was valued at roughly $0.69, representing just a 58% increase compared to the previous year, showcasing its underperformance relative to the broader market recovery.

The low point in April was around $0.51, a significant psychological threshold, and current prices are about 14% above this level. This support area has seen renewed interest from buyers, as shown by recent whale accumulation trends and data indicating exchange outflows.

Analysis of past performance indicates that ADA’s current price is down 81.32% from its all-time high of $3.10 achieved in September 2021, marking one of the largest declines among leading cryptocurrencies.

Support & Resistance: Key Areas Define Range

Immediate support is found around the day’s low at $0.5832, bolstered by the psychological milestone of $0.58, where there has been significant buying activity. The first level of support is at $0.60, corresponding to a persistent trendline created from lows on November 5, April 9, and June 5.

The next important support zone spans $0.5500 to $0.5600, marking a convergence of technical indicators and likely areas for whale accumulation.

Historical support can be found in the $0.4200–$0.4400 range, which aligns with the baseline establishment that occurred in 2023.

Resistance points are noted immediately at $0.6071 (the high of today), followed by the crucial $0.6200–$0.6500 range where the 20-day EMA exerts overhead pressure. Investors who have been waiting for a buying opportunity may consider purchasing Cardano if the price closes above $0.7315, a critical level identified on June 11.

Major resistance is located within the $0.7000–$0.7100 EMA cluster, where the convergence of the 100-day and 200-day EMAs establishes strong overhead resistance. Overcoming this level will necessitate significant volume increases and positive catalysts to break through established selling barriers.

The current price range of $0.58 to $0.61 indicates a compression zone, where directional momentum could emerge swiftly, influenced by volume surges or news developments.

Enterprise Validation: Ford Partnership Transforms Adoption Landscape

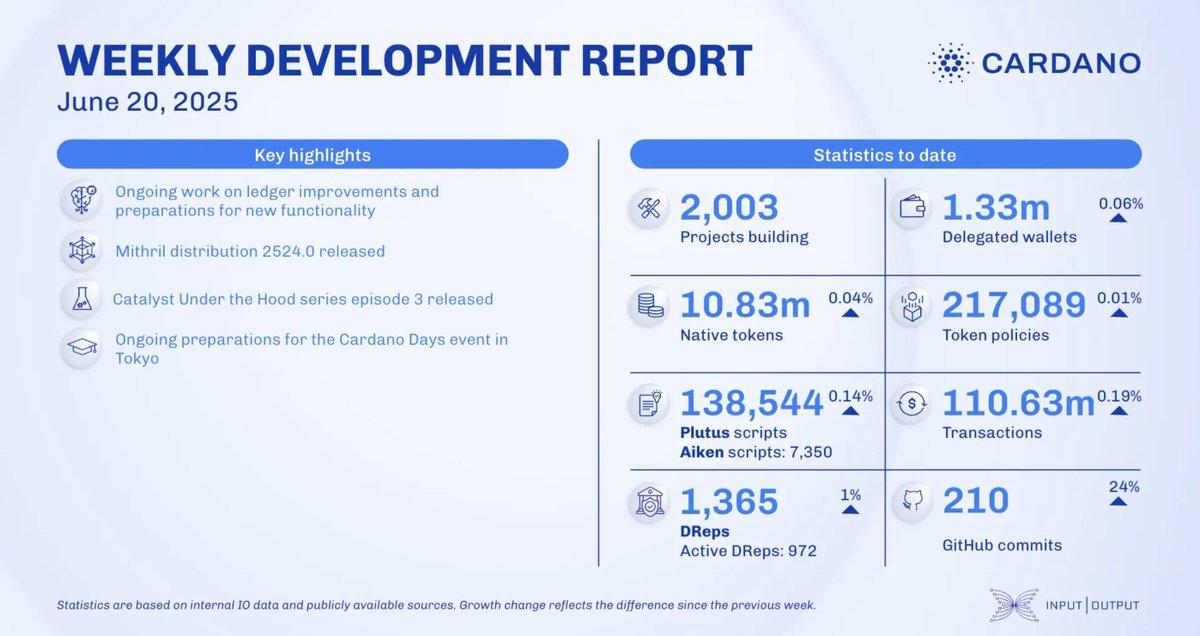

Ford Motor Company has joined forces with Iagon and Cloud Court in a pilot proof-of-concept initiative that utilizes the Cardano blockchain for secure legal data storage solutions. This partnership aims to accelerate the adoption of Cardano within enterprise environments.

This initiative tackles three ongoing issues faced by corporate legal departments: the disorganization of testimony data across teams, security risks stemming from decentralized access controls, and delays in document preparation and coordinating witnesses.

By using a hybrid model, testimony data remains encrypted across distributed nodes. However, Cardano smart contracts keep track of permissions and access events, forming a verifiable chain of custody that complies with regulations such as HIPAA, GDPR, and U.S. court orders.

The proof-of-concept merges Iagon’s decentralized storage platform with Cloud Court’s AI-driven analytics and Cardano’s secure ledger technology.

If Ford backs this system, it could encourage other major companies to see this pilot as evidence that public network infrastructure can meet demanding confidentiality and auditing standards.

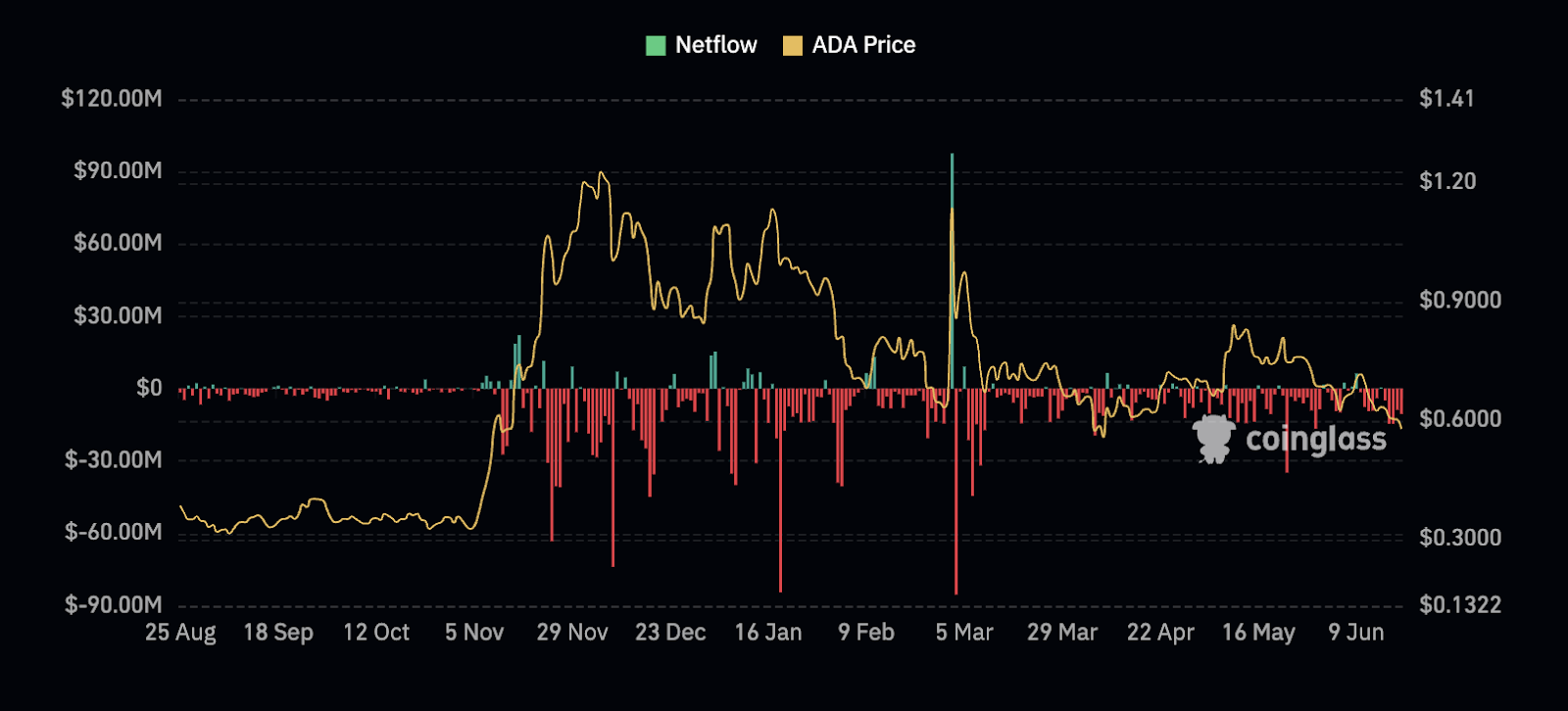

On-Chain Dynamics: Major Capital Exits from Exchanges

Cardano (ADA) is experiencing a surge in popularity, with close to $1 billion worth of ADA taken out of centralized exchanges this year. Blockchain analytics company TapTools reported that around $932 million in ADA has exited exchanges since January.

This significant outflow equates to around 4.6% of ADA’s total market capitalization, showing strong determination among long-term holders even amidst recent price declines.

Typically, such outflows from exchanges precede price recoveries since diminished sell-side liquidity applies upward pressure when demand resurfaces.

Since June 1, major investors holding between 100 million and 1 billion ADA tokens have increased their total from 3.02 billion ADA to 3.15 billion. Additionally, those with over 1 billion ADA tokens have seen their holdings rise from 1.79 billion ADA to 1.97 billion ADA within that period.

The accumulation of 310 million ADA during June’s fluctuations highlights significant confidence at an institutional level, with major holders absorbing selling pressure at lower price points.

Currently, there are 2,384 Cardano whales, defined as addresses holding between 1 million and 10 million ADA. This figure has slightly declined from 2,413 nine days ago but has increased from 2,382 just two days back.

The recent small bounce in whale numbers suggests that accumulation may speed up, with buyers taking advantage of low price levels that haven’t been seen in months.

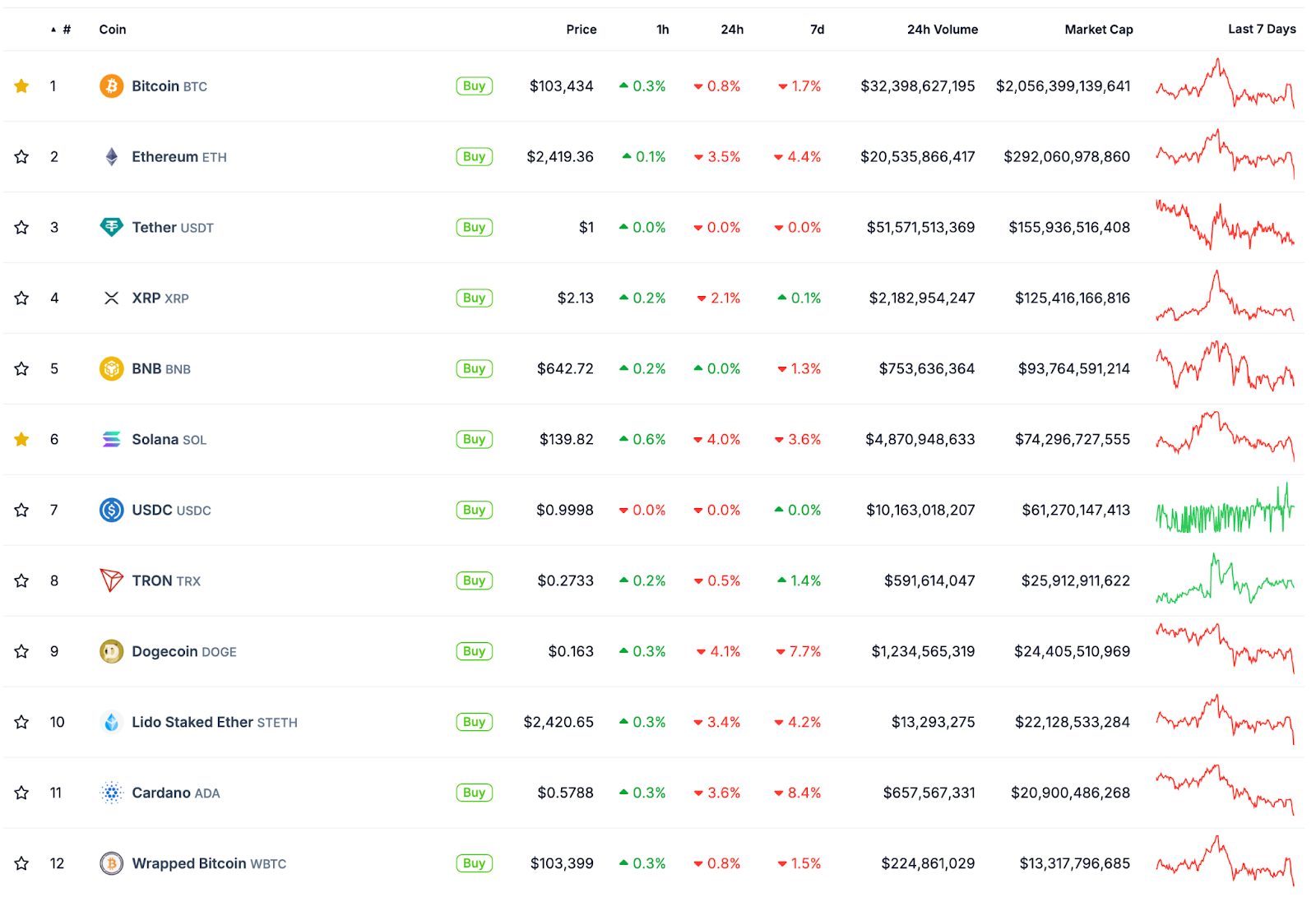

Market Metrics: Strength in Fundamentals Despite Technical Weakness

Cardano retains a market capitalization of $20.41 billion, with a 24-hour trading volume of $564.37 million, resulting in a volume-to-market cap ratio of 2.75%. The fully diluted valuation stands at $26.04 billion, calculated based on a maximum supply of 45 billion ADA tokens.

The current circulating supply is at 35.36 billion ADA, making up 78.6% of the maximum supply. The remaining tokens are earmarked for treasury reserves and staking rewards. This controlled inflation in supply aids in creating long-term scarcity, bolstering potential price appreciation.

ADA is priced at $0.5833, reflecting an 81.32% drop from its all-time high of $3.10 reached in September 2021.

Currently, levels are 3,235% higher than the all-time low of $0.01735 observed in October 2017. This highlights the long-term growth path of the cryptocurrency, even amid recent downturns.

The market share of Cardano remains steady at 0.65% of the total cryptocurrency market capitalization, ensuring it stays within the top eleven digital assets by value, even though it has lagged behind Bitcoin and Ethereum.

According to LunarCrush data, Cardano holds an AltRank of 174, showcasing strong social engagement relative to other cryptocurrencies. The Galaxy Score of 55 indicates a moderate bullish outlook, with total engagement reaching 10.78 million interactions on social media platforms.

Mentions of Cardano have hit 31.21K, with 4.64K creators actively discussing it, demonstrating sustained community interest despite current price challenges. A positive sentiment score of 90% reflects a largely optimistic outlook among the community.

With a social dominance of 2.8%, Cardano effectively captures interest relative to its market capitalization, especially fueled by news of enterprise partnerships that have increased discussion around the topic.

Recent conversations on social media have centered around the significance of Ford’s partnership, long-term ecosystem growth, and opportunities for accumulating Cardano at present price points.

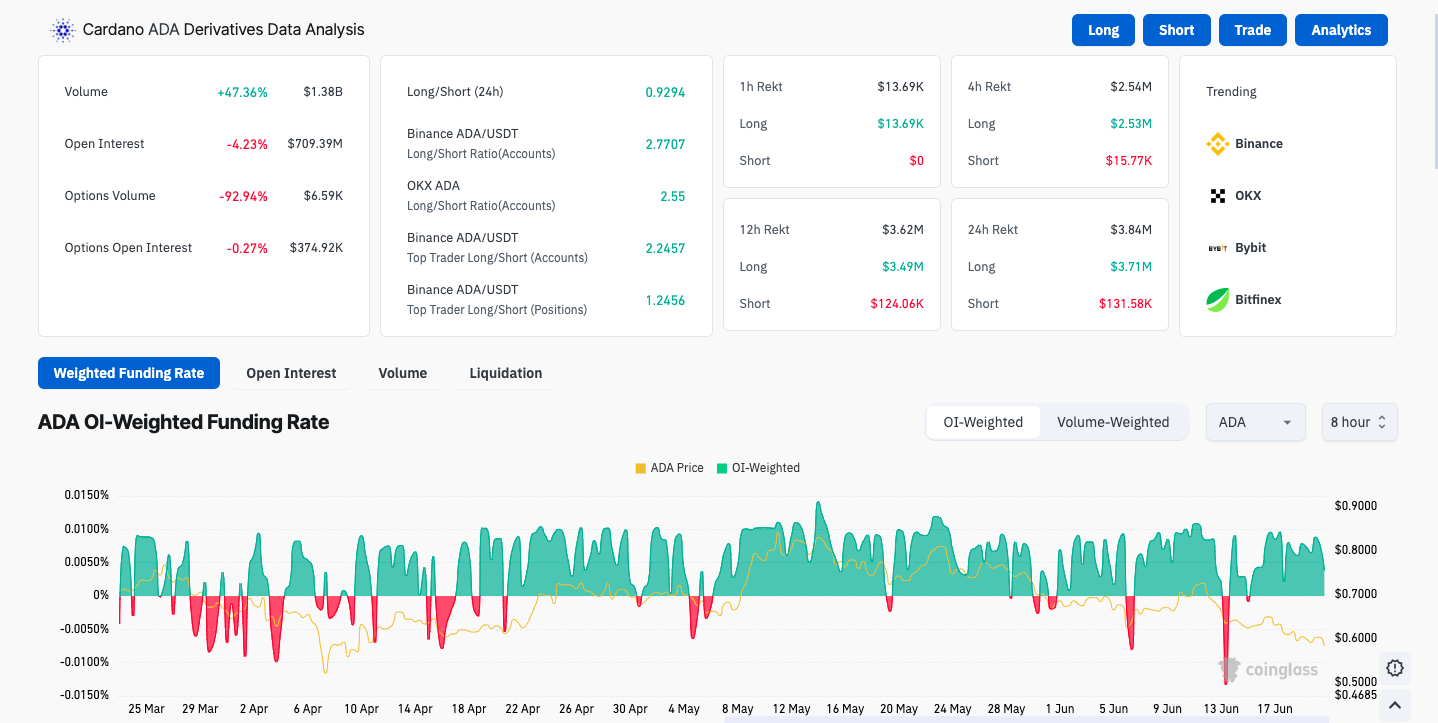

Derivative Markets: Reduced Leverage Signals Capitulation

Data from CoinGlass shows that Open Interest (OI) for Cardano has dropped by over 4%, bringing it down to $709.39 million in the last 24 hours. This decrease in OI suggests a withdrawal of capital from Cardano derivatives, reflecting waning interest from traders.

The funding rate based on OI has corrected to 0.0084% from a previous high of 0.0108% recorded on June 11, indicating a decline in bullish sentiment among leveraged traders. The long-to-short ratio currently stands at 0.9681, with a ratio under 1 suggesting a higher prevalence of short positions.

In the last 24 hours, the number of long liquidations has surged, adding to the selling pressure while also reducing

Leveraged long positions may introduce extra downside risks.

Typically, the process of deleveraging happens before a stabilization in prices, as less resilient investors are removed from the market.

Three-Month ADA Price Prediction Scenarios

Oversold Bounce Recovery (Base Case – 45% Probability)

The RSI falling to an oversold level of 29.66 has historically been followed by relief rallies, especially when coinciding with whale accumulation and lower derivative leverage. The target price sits between $0.62–$0.65, indicating a potential rise of 6–11% from present levels.

For this scenario to unfold, it’s essential to maintain support at $0.58 and achieve a daily trading volume exceeding 80 million ADA. The recovery will encounter initial resistance at the 20-day EMA around $0.65. If it breaks through this level, gains could reach $0.70.

The likelihood of success increases if developments regarding the Ford partnership bolster fundamentals and improve overall altcoin sentiment. To manage risks, a stop-loss should be set below $0.55 to mitigate potential losses.

Enterprise-Driven Breakout (Bull Case – 30% Probability)

If the Ford pilot project succeeds and further enterprise partnerships are established, this could fuel sustained buying interest. Bullish targets are set between $0.74–$0.78, indicating an upside potential of 27–34%. A breakout past $0.74 could lead to further price movements toward $0.80–$0.85.

This scenario hinges on clear progress in enterprise adoption, a general recovery in the cryptocurrency market, and reclaiming multiple EMAs with daily volumes surpassing 100 million ADA.

If these conditions persist, bull traders are targeting a rebound to $0.74–$0.78, with a breakout above $0.74 potentially paving the way for $0.80.

Fundamental drivers should include new partnerships with Fortune 500 companies, successful proof-of-concept achievements, and institutional investments that would help push prices above key resistance levels.

Deeper Correction (Bear Case – 25% Probability)

A failure to maintain support at $0.58 could activate algorithmic selling, driving prices down to $0.55–$0.50. A drop below $0.55 would suggest a more severe correction that could target the low of $0.51 from June or even reach $0.45–$0.48, based on previous support levels.

This situation requires a broader decline in the crypto market, negative company news, or a failure of significant investor accumulation to maintain price stability.

ADA is currently consolidating and struggling to hold support around the $0.620 mark.

ADA Price Outlook: Is ADA Overvalued?

Cardano’s current scenario marks a crucial turning point where extreme oversold market conditions coincide with significant business validation following Ford’s blockchain assessment.

The combination of $932 million in exchange outflows, 310 million ADA being accumulated by large investors, and an RSI close to 30 creates a rare situation not often seen in major cryptocurrencies.

Maintaining support between $0.58 and $0.60 is critical, as dropping below $0.55 could trigger a more significant drop toward $0.50-$0.51.

Nevertheless, patterns of whale accumulation and diminished leverage imply that selling pressure may be nearing its limit.

A recovery calls for reclaiming the 20-day EMA around $0.65 with consistent volume increase, potentially paving the way toward $0.70–$0.75 if supportive business developments arise.

This technical situation offers a favorable risk-reward scenario for strategic accumulation despite potential short-term volatility.

The post ChatGPT o3’s 38-Signal AI ADA Price Forecast Reveals Oversold Bounce Potential Amid Ford Partnership appeared first on Cryptonews.

LATEST:

LATEST: