Access the Editor’s Digest for free

Roula Khalaf, the FT’s Editor, curates her favorite articles in this weekly newsletter.

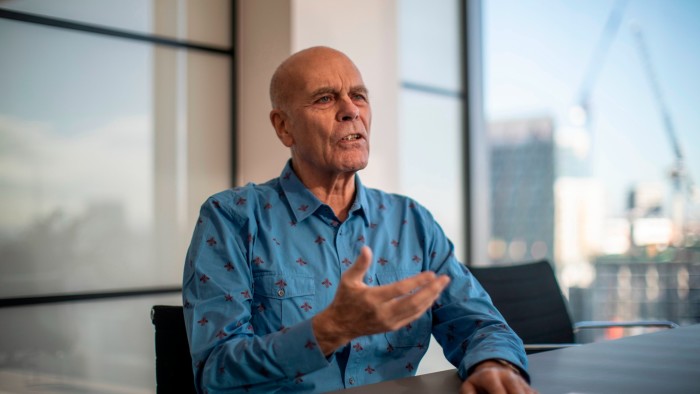

Peter Harf, the chair and managing partner of Europe’s JAB Holdings, is stepping down after over 40 years of building the wealth of Germany’s Reimann family. The vast investment firm he founded is now shifting its focus from consumer goods to insurance and asset management.

The 78-year-old executive from Germany will be succeeded by managing partners and co-CEOs Joachim Creus and Frank Engelen, as announced by JAB on Monday. Creus will take the role of chair, while Engelen will become vice-chair.

Harf’s retirement marks the end of a notable four-decade journey, during which he became one of the most influential dealmakers in Europe.

He is recognized for turning a little-known German chemicals firm, associated with the Reimann family, into a conglomerate with major shares in some of the largest consumer brands worldwide, including Keurig Dr Pepper, Pret A Manger, Krispy Kreme, and JDE Peet’s.

Thanks to Harf, the reclusive Reimann family, whose wealth originated from the 1823 foundation of the chemicals company Benckiser, became billionaires.

In 2012, Harf established JAB Holdings. While managing the family’s wealth and investments in consumer brands, the partners at JAB also sought capital from other affluent families and endowments, enabling more than $50 billion in deals.

However, JAB’s heavy focus on consumer brands was severely tested by significant shifts in consumer behavior during the pandemic and the following inflation surge, which impacted spending. Consequently, JAB is aggressively moving into life insurance and asset management to secure steadier income sources.

A representative for the Reimann family stated that Creus and Engelen have laid out a promising strategic plan to position JAB for sustainable long-term growth in the next generation.

The spokesperson noted that the duo recently launched the firm’s new life insurance division and made their first acquisition in that field. The purchase of Prosperity Life, which oversees $25 billion in assets, valued the company at over $3 billion.

Despite this new direction, JAB maintains sizable interests in consumer firms, including beauty brand Coty and Panera Brands, which operates bakeries and coffee shops. JAB’s portfolio is valued at more than $70 billion.

On Monday, the company announced that Harf will remain “fully invested” in JAB and will continue to chair the Reimann family’s charity, the Alfred Landecker Foundation.

“I want to thank the Reimann family, who entrusted me with this incredible journey over 40 years ago,” Harf said. “It’s time to hand over the leadership to a new generation.”